Filed under: Economy, Personal Finance

With 2011 fast coming to a close, it's time to think about what's next -- if you dare.

The good news is, there's less talk among the experts of a double-dip recession. But there's also little sign that it's time to pop the champagne cork. The general expectation is for the economy to grow between 2% and 2.5% in 2012 -- not great, but better than no growth.

Some are even more pessimistic. In the recently released annual

Bank of America Merrill Lynch 2012 CFO Outlook, 38% of financial executives at U.S. companies said they expected the U.S. economy to expand in 2012, down from 56% in last year's survey and 66% the year before. But only 7% predicted layoffs, and some 46% plan to hire -- the same percentage as planned to in 2011. And 36% said credit had gotten easier to access, compared to 28% last year.

So, there are positive signs, but uncertainly looms large. In the recent

Country Financial Security Index, 30% of respondents said they believed 2012 would be better than 2011, 28% said it would be worse and 32% said about the same.

"Next year will be more about the middle and less about the extremes that we've suffered in 2011," says Mark Lamkin, CEO of Lamkin Wealth Management. Over the last four years, the markets had 2% declines about 100 times more than any other time in S&P history. It also recorded 2% daily gains more times that ever before. "Unprecedented was the norm in 2011. Next year will be a year of meeting in the middle."

Expect a modest, but sustained, recovery. The economy won't fire on all cylinders though, predicted Alan Levenson, chief economist for T. Rowe Price: There are too many "what ifs?"

Here's a look at some of the factors that will help determine the fate of 2012.

The Job Market With unemployment still stuck near 9%, inquiring minds want to know whether 2012 will bring any real relief for job seekers? It may be too close to call. "Job growth picks up in the second half of 2012, but the unemployment rate is expected to be little changed in the fourth quarter of 2012 versus the fourth quarter of this year," said Levenson.

Eurozone Crisis The European sovereign debt crisis won't be solved over night. Some experts are forecasting a mild recession on the Continent, but others go a step further. "Europe will enter a deeper recession with some of the PIIGS [Portugal, Ireland, Italy, Greece and Spain] defaulting and credit downgrades of some major European banks and governments," says Bill Garrett of Garrett Financial.

The European Central Bank is likely to do either a quantitative easing program, a TARP-style program, or a Eurobond deal if Germany approves, or perhaps a combination of these. "This will put Europe in recession, but avoid a run on banks and a Lehman style event," says Lamkin.

China Taps the Brakes Slowing demand from China, combined with Beijing's ongoing money-tightening measures, is prompting concern that this vital engine of economic activity may lose momentum at an inopportune time for the rest of the world, said Scott Berg, portfolio manager of T. Rowe Price's Global Large-Cap Stock Fund.

Stock Market Oscillations For the equities markets, there's just one word -- volatility. The elections, congressional gridlock, and the European debt crisis will be the chief stirrers of the uncertainty pot. "Look for more of the same," says Mickey Cargile, founder and managing partner of Cargile Investment Management. "Investors will need to be patient and have the courage not to bail out of the stock market. I've never seen a stock market that wants to go up as much as this."

Lamkin is optimistic: "With record earnings in the S&P 500 this year, earnings get even better and as confidence returns the P/E's expand for the market," he says. "This leads to a total return in stocks of 8% to 12% for 2012."

Bond Market Inversions "Risky bonds [will] become 'safe' and 'safe' [will] become risky," predicts Lamkin. "Fixed income bonds face headwinds of higher rates before year's end, six months ahead of the Fed's schedule."

Municipal bonds won't have as good a year in 2012 as they did in 2011, but because of a favorable supply and demand outlook, they should post mid-single-digit gains, says Lamkin.

View Poll

The government and corporate bond yield gap will narrow, says Frank Fantozzi, CEO of Planned Financial Services. The performance gap between government and corporate bonds will reverse in 2012, with corporate bonds outperforming as they post modest single-digit gains as interest rates rise and credit spreads narrow. He says bond yields may be volatile within a 1.7% to 3% range, but he expects them to rise over the course of the year, with the yield on the 10-year Treasury ending the year around 3%.

Ongoing economic growth will help normalize interest rates, as will a continuation of Fed policy, stable inflation and tightening fiscal policy. The wide gaps between yield on government bonds and other bonds are likely to converge some in 2012, says Fantozzi.

Gold Keeps Going 2011 was a bull year for gold, with record prices topping $1,900. Will they keep rising in 2012? David Morgan, publisher of

The Morgan Report, which focuses on money, metals and mining, believes precious metals will continue to rise because of the inability of the global financial system to do anything other than take the "easiest" way out of the Eurozone debt crisis: debasing the euro, rather than letting massive debt defaults occur.

Sponsored Links

"I do expect a soft first quarter of 2012," says Morgan. "More consolidation through the summer and higher prices by year end. $60 silver by year end 2012 and gold over $2400. But it may take a year to get to those prices."

"If the euro problem does not get resolved in some meaningful way, gold could begin its move much earlier and faster," says Morgan.

Cargile, on the other hand, says there is no reason to buy gold. "Gold produces no income; it depends on someone buying it for more than you paid. It's a manipulated market, and volatile."

Politics As Usual The U.S. credit rating downgrade was largely caused by political intransigence, and as we roll toward the November elections, it will get harder and harder for the opposing parties in Washington to find common ground. "Political gridlock will continue," says Cargile. "It's working for them, but it isn't for us."

But there's the possibility that as the election nears, Obama and the GOP nominee will leave behind the extremes and meet in the middle, which business likes, says Lamkin. "If voters vote accordingly, the most important budget decisions since World War II will be made with the right candidates with a bipartisan banner. After the election, I believe the market will have a strong fourth quarter based on this meeting in the middle and optimistic outlook."

Housing Begins Its Rebound

The first half of 2012 may be the last great opportunity to purchase a home at the lowest market prices we have seen in many years, and at the lowest interest rates we can remember, says Scott Cramer, endowment strategist and president of Cramer & Rauchegger.

From October 2010 to October 2011, the inventory of existing homes for sale dropped from 3.8 million homes to 3.3 million. That's still an excess of inventory, but we could see a major jump in home sales next year as banks realize that the homes they are holding on to will sell, giving them an incentive to release their inventory more quickly, he says. This could lead to the beginning of a slight increase in home prices by late 2012. The Fed also stated recently that it could ease off its commitment to leave interest rates unchanged until 2013, and could slightly increase rates before the end of 2012.

The Smart Moves for You in 2012

So what does all this mean to you? The experts weighed in on smart moves to make in light of the conventional wisdom about what to expect next year.

o. Seek dividends: One problem companies share with individuals is that their bank deposits aren't making them any money. So some of those earnings are getting paid out in dividends to shareholders. There are many solid, well-run companies with great balance sheets paying more than 4% on an annual basis.

o. Consider small and mid-cap U.S. stocks: These should provide attractive returns for investors in 2012, in part due to mergers and acquisitions activity powered by large corporate cash reserves.

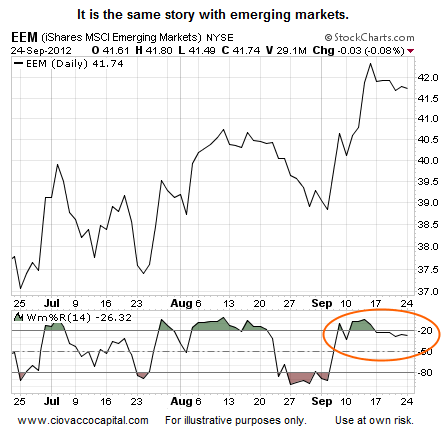

o. Skip emerging markets ... or not: The jury's still out on emerging markets. Some experts say to avoid them, "Buy domestic, not emerging markets or Europe. Buy what you understand. U.S. corporations are strong," says Cargile. But other experts think they're returns will exceed those of developed markets. Long term, emerging markets offer intriguing growth prospects.

o. Get creative: You may have dismissed bonds because with a fixed income vehicle, the interest rate is locked in and principal will be negatively impacted by inflation. However, a step-up bond starts with one rate, then increases after a period of time. This gives the fixed income investor a degree of inflation protection, says Cary Guffey, a financial adviser with NBC Securities.

o. Keep up good habits: The recession tamed consumer spending, sparked saving and inspired us to pay down debt. Don't stop in 2012. Start or continue building your emergency fund until you have at least six months of living expenses stashed. Diversify. Stay cool when it comes to the stock market. The wild ride is far from over. Rethink any rash moves motivated by emotions.

Mostly, be ready for anything.

Correction: A previous version of this story referred to Mickey Cargile's firm as WNB Private Client Service. In 2011, that company changed its name to Cargile Investment Management.

Permalink | Email this | Comments

Source: http://www.dailyfinance.com/2011/12/28/the-economy-ahead-what-to-expect-in-2012/

best site blog

Running out of money in retirement is the biggest fear facing investors in the current economic environment, according to Millionaire Corner research, but a new study from the University of Missouri indicates that investors who retire at market highs often face trouble down the road.

Last week, we reported that experts and health officials are concerned that Gulf cleanup workers

Last week, we reported that experts and health officials are concerned that Gulf cleanup workers  The catastrophe unfolding in the Gulf of Mexico has been portrayed as a one-of-a-kind disaster, a perfect storm of bad equipment, bad planning and bad luck.

The catastrophe unfolding in the Gulf of Mexico has been portrayed as a one-of-a-kind disaster, a perfect storm of bad equipment, bad planning and bad luck. With 2011 fast coming to a close, it's time to think about what's next -- if you dare.

With 2011 fast coming to a close, it's time to think about what's next -- if you dare.